Advisory Board for Banking and Financial Frauds to Shield PSBs/ PFIs for Boost Lending

The Central Vigilance Commission (CVC) afraid of fear of investigative agencies among officers of the rank of general managers and above of Public-Sector Banks (PSBs) and Public-Sector Enterprises (PSEs) during their commercial decisions at the time of granting various financial facilities to the borrowers, decided to set up an advisory board to examine (at first level) all large fraud cases of PSBs and PSEs before recommendation is made to the investigating agencies, including CBI. The Commission, in August 2019, in consultation with the RBI and based on the recommendation of an expert committee of NPAs and frauds constituted an ‘Advisory Board for Banking Frauds (ABBF)’. The ABBF was empowered to examine (at first level) cases of frauds of above Rs. 50 crore

involving officers of the rank of general manager and above in PSBs and equivalent thereof in Public Financial Institutions (PFIs) before such organisations initiate action in the matters of allegation of banking and financial frauds and to give advice to such officers under all relevant laws. All PSBs and PFIs were mandatorily required to refer all the matters of suspected frauds involving money of above Rs. 50 crore, wherein officers of the rank of general managers and above are involved, for seeking advice of the board before initiating any inquiry or investigation. Further, during the course of investigation, if there is involvement of such officers of PSBs and equivalent thereof in PFIs, comes to the notice of investigating agencies, it may refer the matter to the board for advice before proceeding further. Recently, considering the fear of probe among such officers and to boost lending by banks/ financial institutions, the Ministry of Finance in consultation with 3Cs, (CBI, CVC and CAG) considered the distinction between genuine commercial failures and deliberate wrong-doings, and to protect such officers whose commercial decisions were genuine and to shield PSBs and PFIs from the potential harassment from the investigating agencies, and due to recent changes in the nature of economic offences and the changes in law as well as due to increase in the complexities and difficulties being faced in technical matters, strengthened and renamed panel setup by CVC in August 2019, as Advisory Board for Banking and Financial

Frauds (ABBFF) to ensure the bankers that they can take commercial decisions for lending money to borrowers without any fear of facing investigation if bonafide decision goes wrong in future. The Panel will review cases of financial frauds involving general manager and above rank officers in PSBs and equivalent thereof in PFIs before any action is initiated by the bank. Besides this, all financial institutions shall refer all large frauds of above Rs. 50 crore to the Board and the investigating agencies will seek advice of the board before initiating any action. The government is keen interested to boost overall Indian economy so assured PSBs and PFIs to take speedy and fearless commercial decisions while granting financial facilities to the borrowers. All administrative ministries, organisations and government entities shall seek advice of ABBFF and the said advice will be taken into consideration by the Investigating Agency. The said Board, ABBFF is the need of the prevailing circumstances to boost

2

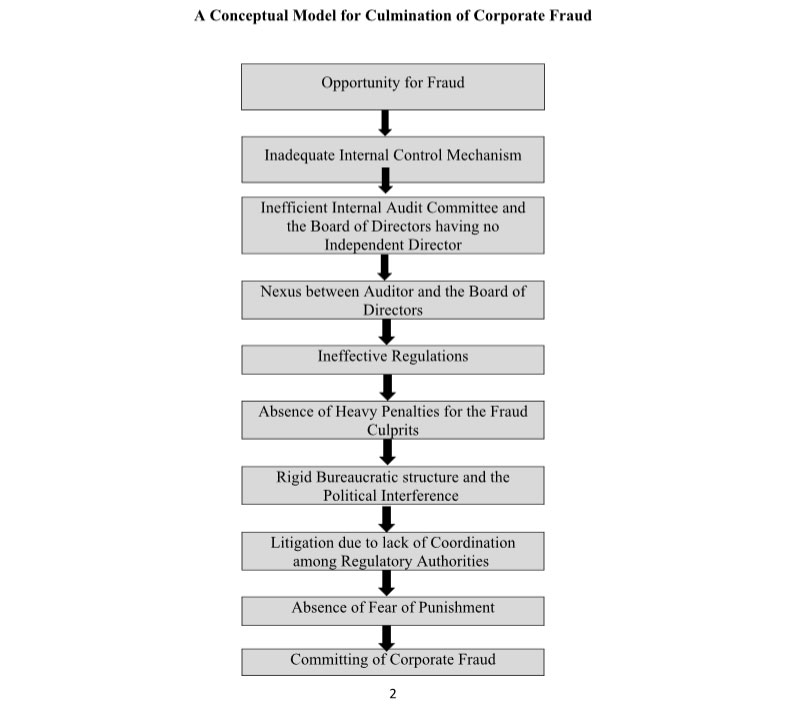

lending/ granting various financial facilities to the borrowers by PSBs and PFIs. Now, after setting up of the board, no inquiry can be started without the approval of the board by investigating agency. The fraud adversely effects the growth of the economy as the hard-earned money of general public is siphoned off through banking channel. The impact of corporate frauds on the economy are higher cost, slower growth, and reduction in employment, increased government

control, and adverse effect on overall growth of the country. The major consequences of corporate frauds on the economy include imposition of increased government controls, higher cost of projects and loss of confidence of foreign investors, which in turn lead to retarded growth of the economy and reduction in employment opportunities. The author, during his doctoral research on corporate frauds, developed a conceptual model for culmination of corporate fraud, which is given below:

At the end, it is doubtful as to how it will be judged that commercial decision taken by the general manager and above rank officers of PSBs and equivalent thereof in PFIs was genuine and as to who are the financial experts or fraud prevention / detection experts with the board to analyse the financial transactions and procedures for fraud cases. It is suggested to the Union Finance Minister, Nirmala Sitharaman, that the panel should be kept away from any political or bureaucratic influential interference for its working and

decisions, lest the purpose for setting up of ABBFF is defeated and few experts in the field of finance, financial transaction analysis, documentation, and fraud detection are to be engaged by the board for their expert advice .

In sum, I appreciate our Prime Minister , Shri Narender Modi, Home Minister, Shri Amit Shah and Finance Minister, Mrs. Nirmala Sitharaman for considering the concerns flagged of by the experts and industry leaders of their concerns regarding genuine business failures and subsequently establishing the ABBFF to reduce the fear of investigating agencies among officials of PSBs and PFIs to boost lending by PSBs and PFIs to the borrowers to meet their

financial needs.