Under the Companies Act, 2013, companies which are registered under the Companies Act, 2013 or any other previous Companies Act are required to file various forms with the Registrar of Companies (ROC), Regional Director (RD) or National Company Law Tribunal (NCLT) , etc.. for both annual compliance and event-based reporting. These forms serve as a means of providing crucial information to regulatory authorities, ensuring transparency, accountability, and adherence to legal requirements.

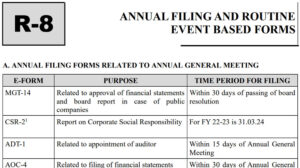

Annual filing forms are submitted by companies on an annual basis to fulfill their statutory obligations. The key annual filings forms are AOC 4 regarding filing of Financial statements,MGT-7 regarding Annual Return, ADT-1 regarding appointment of statutory auditors, etc. which provides to stakeholders with insights into the company’s financial health, performance, and governance practices, details about the company’s registered office, shareholding pattern, directors, and key management personnel.

Furthermore, companies are required to file various event-based forms to report significant occurrences or changes within the organization. Timely submission of these forms is crucial to avoid penalties and ensure compliance with legal requirements. Non-compliance or delayed filing may result in fines, prosecution, or adverse legal consequences, potentially tarnishing the company’s reputation and credibility.

In summary, annual filing forms and event-based forms under the Companies Act, 2013, serve as vital tools for regulatory compliance and transparency in corporate governance. By providing accurate and timely information to the respective authority, companies uphold legal and ethical standards, instilling trust and confidence among stakeholders. The author has tried his best to compile the list of various e-forms which are required to be filed by a company annually or on the happening of certain events within a stipulated time period.

The details provisions can be studied from my book titled as Company Law Procedures and Compliances.