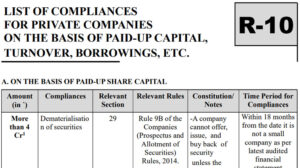

Private Limited companies in India registered under the Companies Act, 2013 or any other previous Companies Act are subject to various compliance requirements based on factors such as paid-up capital, turnover, and borrowings. Compliance ensures transparency, accountability, and protection of stakeholders’ interests. Private Limited Companies companies must adhere to specific compliance requirements based on their paid-up capital, turnover, borrowings from banks or financial institutions, etc, . For instance, to appoint a company secretary, directors, cost auditors and constitution of various committees.

In summary, private limited companies in India must fulfill various compliance obligations based on factors such as paid-up capital, turnover, and borrowings. By adhering to these requirements, companies uphold corporate governance standards, protect stakeholders’ interests, and contribute to a transparent and well-regulated business environment. The author has tried his best to compile the compliances of a private limited company on the basis of certain threshold limits of capital, borrowings, and turnover.

The details provisions can be studied from my book titled as Company Law Procedures and Compliances.