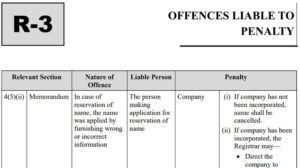

It is to be noted that if a company or any officer of the company or any concerned person contravene any provisions of the applicable section of the Companies Act, 2013 or any earlier enactment thereof, the company and the officer in default and the concerned person, pursuant to the contravene of a concerned section (a) shall be punishable with fine, with fine or imprisonment, with fine or imprisonment or with both, with fine and imprisonment, (b) shall be liable to a penalty and (c) shall be liable for action under section 447 of the Act (punishment for fraud). Pursuant to the Companies (Amendment) Act, 2019, some of the provisions have been amended by substituting the word ‘fines’ with ‘penalties’ as violation of provisions of these specified sections should be categorised as civil liabilities because they are merely technical or minor non-compliances, which may be rectified by levy of penalty instead of filing prosecution in courts and therefore, certain offenses which were earlier punishable with fine or imprisonment or with both, are presently punishable with penalty, instead of being punishable with fine or imprisonment or with both as to promote ease of doing business and unclog the criminal courts and Tribunals processes while in order to impose fine/imprisonment, one has to initiate criminal prosecution, whereas penalty needs only adjudication and the Central Government may appoint any of its officers, not below the rank of Registrar, as adjudicating officers for adjudging penalty under the provisions of the Act and it can be stated that the Act has carved our certain sections which have been brought under adjudication process in respect of which the process compounding of offences under Section 441 will not apply.

The details provisions can be studied from my book titled as Company Law Procedures and Compliances.