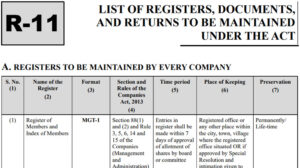

Please note that under the Companies Act, 2013 and the rules made thereunder, prescribe specific records of a company’s shareholders, directors, deposits, loans, guarantees, etc. to be prepared and maintained under a stipulated time and to be kept for a particular period. These registers are to be maintained at the company’s registered office.

The term “book or paper” encompasses a wide range of documents, including books of account, deeds, vouchers, writings, documents, minutes, and registers, whether maintained on paper or in electronic form.

Books of account refer to records kept concerning:

(i) all monetary transactions received and expended by the company and related matters;

(ii) all sales and purchases of goods and services made by the company;

(iii) the assets and liabilities of the company; and

(iv) the cost items as may be prescribed under section 148, applicable to companies falling within the categories specified under that section.

The details provisions can be studied from my book titled as Company Law Procedures and Compliances.