In the dynamic realm of corporate governance in India, the Director Identification Number (DIN) stands as a quintessential tool for regulating and identifying individuals serving as directors in the companies registered under the Companies Act or any previous Companies Act. The genesis of the DIN system can be traced back to the Companies (Amendment) Act, 2006, which heralded a paradigm shift in the regulatory framework governing corporate entities registered/incorporated in India. DIN serves as a unique identification number for directors, ensuring transparency, accountability, and regulatory compliance. The author, in brief, delves into the nuances of DIN, its significance, the process of obtaining and maintaining it, and the regulatory requirements associated with it.

DIN is a unique identification number assigned to individuals intending to become director of companies registered under the Companies Act, 2013 or any other previous Companies Act in India. It serves as a means to track and regulate the activities of directors and helps in preventing fraud, identity theft, and unauthorized appointments to directorial positions within companies.

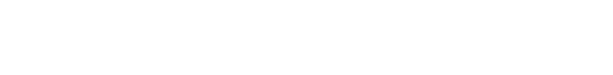

It is to be noted that for Indian citizens, DIN is based on their Permanent Account Number (PAN) while for foreign nationals, DIN is based on their passport details. A person intended to be appointed as a director in an existing company, cannot be appointed as a director of a company registered under the Companies Act, 2013 or under any previous Companies Act, without a valid Director Identification Number while a person intended to be appointed a director in a new company which is to be formed, he can be appointed as a director as during the incorporation of a company, up to three persons can obtain DIN simultaneously with the incorporation of a company. If a person does not have a DIN at the time of appointment as a director, a board resolution is required to be passed by the company in which he is intended to be appointed as a director. This resolution authorizes the individual’s appointment and initiates the process of obtaining DIN.

A person cannot hold more than one Director Identification Number at a time as this is to prevent individuals from assuming multiple identities or engaging in fraudulent activities. To preclude instances of identity duplicity and mitigate the attendant risks, the Companies Act, 2013 and rules made thereunder imposes a categorical prohibition on individuals holding more than one DIN. Stringent enforcement mechanisms are deployed to detect and deter contraventions, underscoring the imperative of regulatory compliance in safeguarding the integrity of the director identification system.

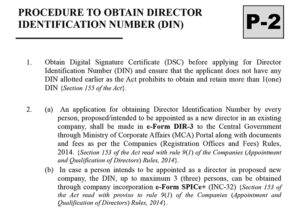

Once the DIN is allotted and if there are any changes in the particulars filed during the process of obtaining DIN, the said changes must be promptly intimated to the Ministry of Corporate Affairs Any alterations or amendments in the particulars furnished during the DIN application necessitate expeditious intimation to the Ministry of Corporate Affairs. Timely notification of changes epitomizes a commitment to transparency, regulatory compliance, and the preservation of data accuracy within the DIN repository. To register the changes in the particulars of allotted DIN, e-Form DIR-6 must be filed for change in particulars of DIN. This ensures that the information maintained by the MCA remains accurate and up-to-date.

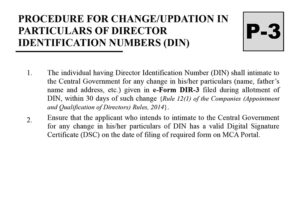

Persons having DIN are required to undergo Know Your Customer (KYC) verification annually to ensure the continued validity of their DIN and this process helps in verifying the identity and credentials of directors, thereby enhancing the integrity of corporate governance. Amendments to the Companies Act and auxiliary regulations have played a pivotal role in shaping the contours of the DIN regime, catering to the evolving needs of the corporate ecosystem.

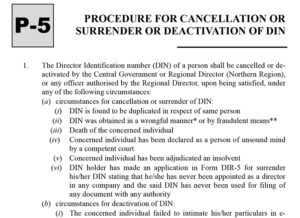

Instances of non-compliance with DIN-related regulations, encompassing infractions such as possession of multiple DINs or dissemination of false information, invoke punitive sanctions and legal repercussions. Directors and corporate entities found culpable of contravening DIN provisions may be subject to fines, disqualification, or other punitive measures, accentuating the indispensability of regulatory adherence and compliance.

The details provisions can be studied from my book titled as Company Law Procedures and Compliances.